| Administrator Guide > Recovery Process Overview > Debt Cancellation |

When an account is charged-off and the financial institution writes off the debt, a 1099C form is sent to the debtor and then to the IRS so the financial institution can declare a loss on their taxes. The Debt Cancellation page in System Management (System Management > Recovery > Debt Cancellation) provides administrators with the ability to review recovery accounts and create a file to export the accounts to a third party for the creation of 1099C (Cancellation of Debt) documents.

|

The Debt Cancellation page is only available in System Management if the Recovery module is active in the Lifecycle Management Suite and permissions to the Debt Cancellation page are defined for the user within User/Group Permissions. This page serves as tool to track debt cancellation accounts and whether or not they have been reported; it does not actually export the account information to the third party. |

The Debt Cancellation page displays all fully and partially charged-off accounts that have a value defined within the Uncollectable Closed Date field.

|

The Uncollectable Closed Date is the date the account was considered uncollectable. This field can be set on an account manually by a user or automatically through rules. |

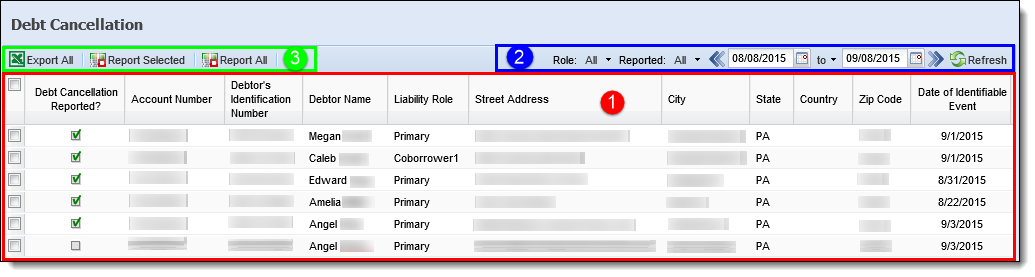

This page contains the following functionality to view and track debt cancellation accounts:

Information is displayed within the following grid columns on the Debt Cancellation page:

| Column | Description | ||

| Debt Cancellation Reported? | Displays a  if the account has been processed for debt cancellation reporting. if the account has been processed for debt cancellation reporting. |

||

| Account Number | Displays the account number. | ||

| Debtor's Identification Number |

Displays the debtor's SSN.

|

||

| Debtor Name | Displays the debtor's full name. | ||

| Liability Role | Displays the debtor's role on the account. | ||

| Street Address | Displays the debtor's street address. | ||

| City | Displays the debtor's city. | ||

| State | Displays the debtor's state. | ||

| Country | Displays the debtor's country. | ||

| Zip Code | Displays the debtor's postal code. | ||

| Date of Identifiable Event |

Displays the date the Uncollectable Closed Date field was set on the account.

|

||

| Amount of Debt Discharged | Displays the account's initial balance. | ||

| Interest Amount | Displays the initial interest amount. | ||

| Debt Description | Displays a short description of the debt amount. | ||

| Identifiable Event Code | Displays the value set in the IRS_IDENTIFIABLE_EVENT_CODE lookup field. This value indicates the reason for the income, such as Debt Unenforceable or Settlement Discharge. | ||

| Fair Market Value | Displays the account's collateral market value. |

|

The Identifiable Event Code, Uncollectable Closed Date, Debt Description, Fair Market Value, and Debt Cancellation Reported fields are available for addition to queues, views, reports, screens, and rules. |

The following filters display within the Debt Cancellation page to control the account records that are displayed within the grid:

| Filter | Description | ||

| Role |

From the drop-down, select the account roles to display within the Debt Cancellation grid. All roles configured within System Management > Role Types are displayed.

|

||

| Reported |

From the drop-down, select one of the following reported statuses to display accounts that have or have not been reported within the Debt Cancellation grid:

|

||

| Date | Select a date range using the calendar icons and click  to filter the accounts by date. Accounts that have been marked as Reported within the selected date range display within the Debt Cancellation Grid. to filter the accounts by date. Accounts that have been marked as Reported within the selected date range display within the Debt Cancellation Grid. |

The following buttons display within the Debt Cancellation page to process Debt Cancellation records:

|

Due to the pagination of the Debt Cancellation grid, clicking these buttons can cause processing to occur on accounts that are not currently displayed within the grid. |

| Button | Description | ||

|

Click this button to export all accounts, displayed according to the filters, to Excel. This functionality enables the administrator to review and edit debt cancellation data in Excel before it is sent to the third party for the printing of 1099C documents. | ||

|

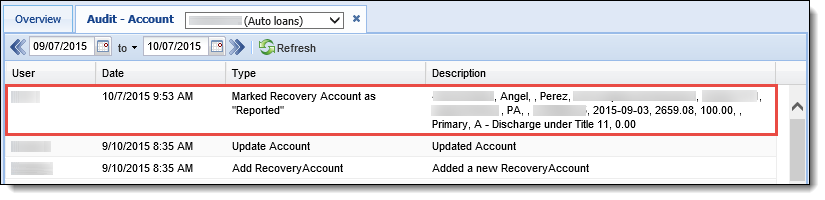

Click this button to mark the accounts, displayed according to the filters and selected within the grid, as having been reported. When a record is marked as reported, an entry is added to the account's Audit History screen displayed in the Lifecycle Management Suite workspace.

|

||

|

Click this button to mark all accounts, displayed according to the filters, as having been reported. When a record is marked as reported, an entry is added to the account's Audit History screen displayed in the workspace.

|

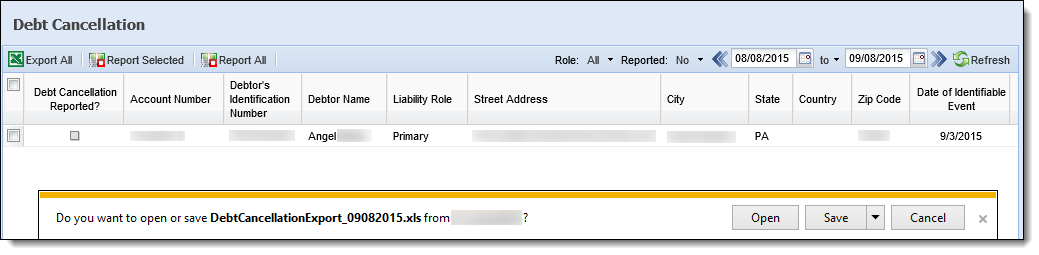

To process debt cancellation accounts, select the desired filter options from the top of the page and review the results displayed within the Debt Cancellation grid.

When the desired accounts are displayed within the grid, click  . A prompt to open or save the Debt Cancellation Export file is displayed. Select Save As from the Save drop-down and save the file to the desktop or another location to be exported to the third party.

. A prompt to open or save the Debt Cancellation Export file is displayed. Select Save As from the Save drop-down and save the file to the desktop or another location to be exported to the third party.

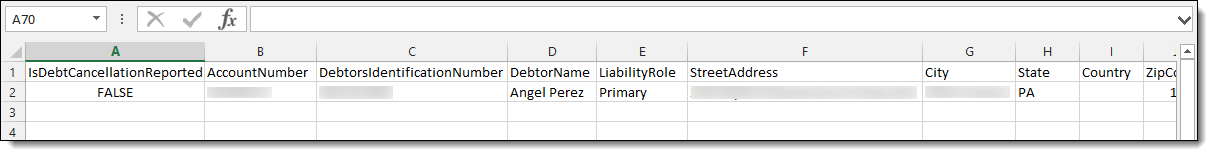

Open the tab-delimited Debt Cancellation Export file in Excel and review its contents for accuracy.

|

Upon opening the export file, a warning message is displayed indicating that the file extension does not match. This is expected behavior as the Lifecycle Management Suite does not generate the export file as an XLS (Excel) file. Click Yes to close the message and open the export file. |

|

Information displayed within the Creditor fields (Creditor Name, Creditor Street Address, etc.) is obtained from System Management > Administrative Settings. |

When finished reviewing the Debt Cancellation Export file, close the file or save and close the file if any changes have been made.

|

The financial institution should work with their forms provider to determine the best method to transmit the Debt Cancellation export file. |

Once the file is ready for export or the file has been successfully exported to the third party, return to the Debt Cancellation page within the Lifecycle Management Suite.

Review the accounts within the grid and indicate those that have been included in the export by selecting the check box next to each record.

|

If all accounts within the grid have been included in the export, there is no need to manually select each record. |

Once all desired accounts are selected, click  . If all accounts within the grid have been included for export, click

. If all accounts within the grid have been included for export, click  . A prompt appears to confirm that the accounts should be marked as reported. Click Yes.

. A prompt appears to confirm that the accounts should be marked as reported. Click Yes.

The Debt Cancellation Reported flag is set to true and a message appears stating that the accounts have been successfully marked as reported. Click OK to close the message.

|

Once the Debt Cancellation Reported flag is set to true, it cannot be changed or set back to false. This ensures that accounts are not reported more than once. |

A record containing a comma-delimited list of all of the account's values in the export file is added to the account's Audit History screen.